On Tuesday NVIDIA (Nasdaq: NVDA) shares surged 3.97%, significantly outpacing the Nasdaq’s 0.56% gains. Many investment websites pointed to CEO Jensen Huang ending a stock sale program as the catalyst for the company’s gains. However, other news might be a larger factor in today’s gain.

Let’s look at why NVIDIA surged today and whether the news could lead to gains in the months ahead.

Need to Know News

- NVIDIA’s stock jumped 3.97% on Tuesday

- Many financial news outlets attributed the gains to CEO Jensen Huang ending a stock sale program

- However, positive Wall Street research on Blackwell may be the larger contributor to NVIDIA’s jump

- If you’re watching the AI space become technology’s next megatrend and looking for ways to profit beyond NVIDIA, make sure to grab a complimentary copy of our brand-new “The Next NVIDIA” report. It features a ’10X Moonshot’ stock we believe could dominate the next wave of AI.

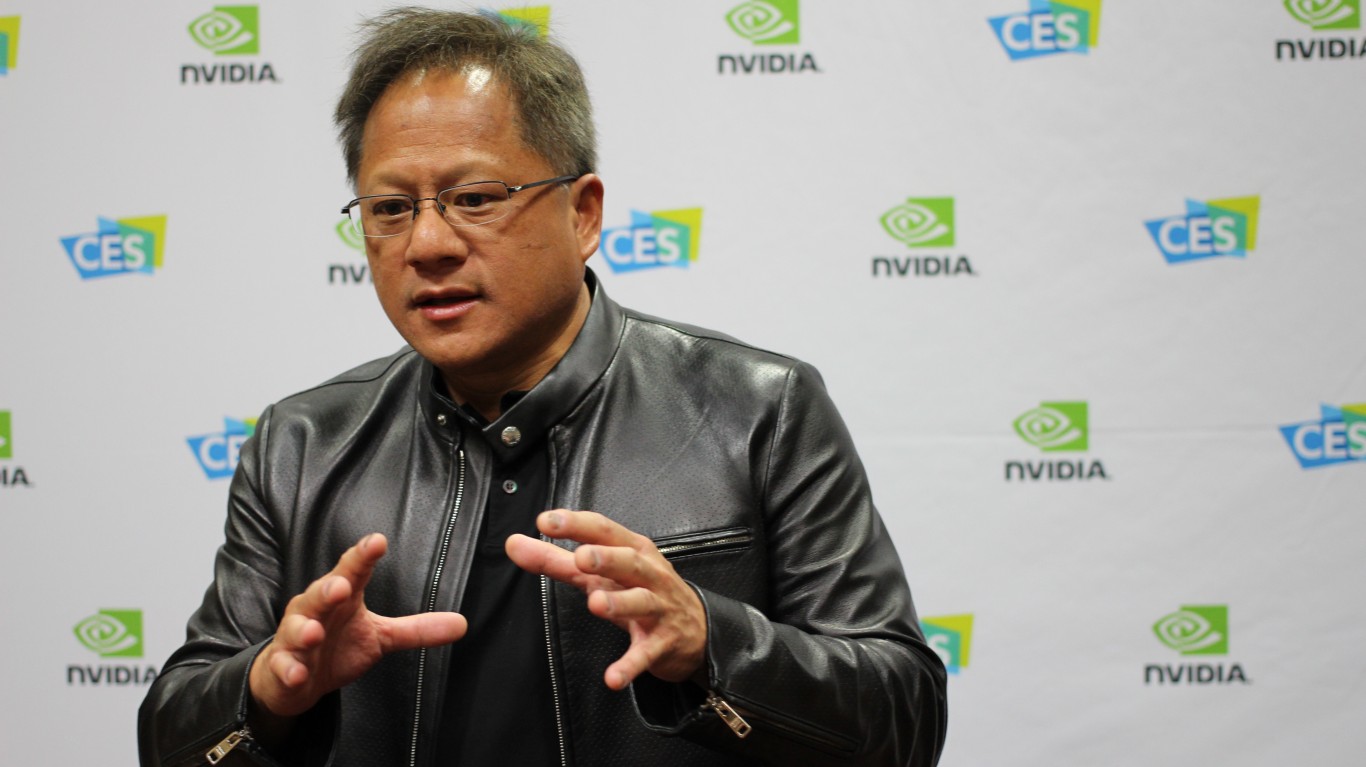

Why the Media Said NVIDIA Surged

Earlier this year, Jensen Huang began a share sale program. These programs are common for CEOs, but Huang’s had a limit of about 6 million shares. As of Huang’s September 13th sale (which you can see the details of on the SEC’s website), Huang reached the limit of this 10b5-1 plan.

There are dozens of media reports speculating that the end of this plan led to NVIDIA’s jump today. However, it’s worth noting:

- Huang sold about $700 million worth of shares, constituting less than one percent of his total shares. At today’s share price, Huang still owns about $104 billion worth of NVIDIA stock.

- NVIDIA’s trading average volume is $40 billion. Huang sold shares across 3 months, meaning his total shares sold in this span were roughly .02% of all NVIDIA shares trading hands.

Put more simply, as far as CEO stock sales go, a sale of less than 1% of Huang’s shares accounting for .02% of NVIDIA’s valuation doesn’t seem to be as material as the headlines make it out to be.

NVIDIA’s Shares Surge Rapidly

Another interesting face of NVIDIA’s trading today is that the company’s share price was $115.70 at 10:40 before rapidly climbing over $121 per share by noon.

It seems some news rapidly caused buying activity in NVIDIA’s shares.

One very interesting research note around NVIDIA came from Morgan Stanley today. The researcher noted that NVIDIA’s next-generation Blackwell chips are now entering volume production.

Morgan Stanley believes NVIDIA could produce 450,000 chips in the fourth quarter of 2024, translating to a ‘potential revenue opportunity exceeding $10 billion’ for NVIDIA. This is a very interesting note as NVIDIA guided in their most recent earnings that they’ll see a ‘few billion’ in revenue from Blackwell in the fourth quarter.

If Morgan Stanley is right, NVIDIA may be ahead of schedule, which could lead to a large fourth-quarter earnings surprise. In addition, Morgan Stanley noted NVIDIA continues to see strong demand for its prior generation H200 chips selling to hyperscalers and sovereign AI projects.

Blackwell May Be Driving NVIDIA’s Gains Today

Reading the tea leaves on why a stock jumps any particular day is an inexact science, but when I look across NVIDIA news, my guess is that Morgan Stanley’s research note is the primary driver for NVIDIA’s stock surge today.

If they are ahead of schedule, traders are likely trying to position themselves ahead of rising expectations for NVIDIA earnings in the fourth quarter.

“The Next NVIDIA” Could Change Your Life

If you missed out on NVIDIA’s historic run, your chance to see life-changing profits from AI isn’t over.

The 24/7 Wall Street Analyst who first called NVIDIA’s AI-fueled rise in 2009 just published a brand-new research report named “The Next NVIDIA.”

Click here to download your FREE copy.

The post Is This the Real Reason NVIDIA’s Stock Surged 4% on Tuesday? appeared first on 24/7 Wall St..