While we all hope that businesses large and small are out in the world doing the best job possible to be scandal-free, it’s simply not reality. Instead, companies often cut corners or have executives who look for the easy road to navigate lousy PR, poor quarterly numbers, and bloated executive pay. With this in mind, let’s look at some companies ruined by massive scandals.

12. Bernard L. Madoff Investment Securities

- Scandal: Ponzi scheme

At the time of Bernie Madoff’s arrest, his investment securities business was the 6th largest market maker among S&P 500 stocks. The arrest ruined the company and wiped out billions of shareholder value.

11. Valeant Pharmaceuticals

- Scandal: Deceptive pricing practices, questionable accounting

The SEC investigated a major pharmaceutical brand, Valeant, for manipulating the market by buying up competitors to drive up the price of its drugs. The company saw its stock price drop 90 percent and had to rebrand completely to avoid public anger.

10. Parmalat

- Scandal: False accounting records

One of the world’s largest dairy and food companies, Italian giant Parmalat, was sold off in pieces after a $20 billion hole was found in its accounting records. The CEO was convicted of fraud and sentenced to 18 years in prison.

9. Adelphia Communications Corporation

- Scandal: Corruption, misappropriation of company resources

A cable television giant for many years, Adelphia Communications Corporation went under in 2002 after it was discovered the founding family was misusing funds for personal luxury purchases. The company would later be sold off to Time Warner Cable.

8. Barings Bank

- Scandal: Fraudulent investments

One of England’s oldest merchant banks, Barings Bank, went under in 1995 after suffering hundreds of millions of losses due to fraudulent investments. The bank would later be sold for one pound or $1.31 in American currency.

7. Bear Stearns

- Scandal: Subprime mortgages

Bear Stearns was a major victim of the collapse of subprime mortgage housing. This scandal caused the housing market to collapse and ripple throughout the world’s financial sectors.

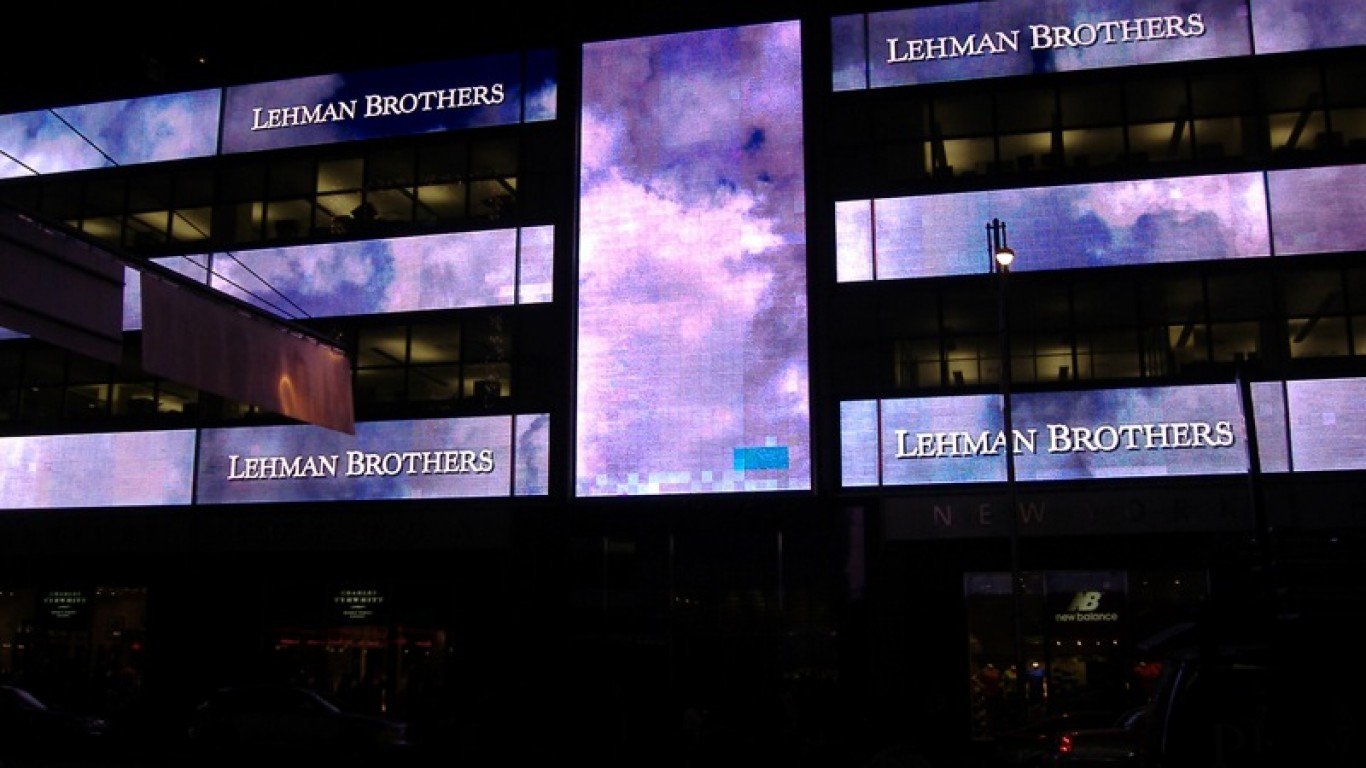

6. Lehman Brothers

- Scandal: Subprime mortgages

The investment bank giant Lehman Brothers filed for bankruptcy in 2008 after betting heavily on risky subprime mortgages caused by banks lending money to those who couldn’t afford the payments.

5. HealthSouth

- Scandal: Accounting fraud

In 2002, the first signs of scandal appeared after the SEC discovered the insurance company’s earnings were falsely inflated by $1.4 billion. The company was ruined and forced to rebrand before going public again.

4. Turing Pharmaceuticals

- Scandal: Price gouging life-saving medicine

Martin Shrekli will be forever remembered for upping the price of one of Turing Pharmaceuticals’ drugs by 5,000 percent to boost the company’s bottom line. The resulting scandal forced the company to rebrand, and Shrekli was put in prison.

3. WorldCom

- Scandal: $11 billion accounting fraud

In 2002, WorldCom was a telecom giant, only to be rocked by a $11 billion scandal involving inflated company assets. The resulting scandal led to WorldCom filing for bankruptcy and multiple executives pleading guilty to fraud.

2. Theranos

- Scandal: False claims about testing blood

Theranos is a textbook example of a company ruined by a massive scandal. Promising a revolutionary way to test blood, Theranos couldn’t do anything it promised, and its $9 billion valuation went up in smoke.

1. Enron

- Scandal: Accounting scandal, auditing failure, bankruptcy

Enron was the largest bankruptcy in US history at the time after losing $74 billion, and it is undoubtedly the biggest company completely ruined by scandal. Along with Enron, its accounting firm, Arthur Anderson, was also destroyed by the Enron scandal.

ALERT: Take This Retirement Quiz Now (Sponsored)

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.

The post This Company Paid the Price for a Scandal With $74 Billion Lost appeared first on 24/7 Wall St..